Things Lender Look at When You Apply for Instant payday loans online guaranteed approval

Instant payday loans online guaranteed approval come at a cost that most persons may not really know about.

Ordinarily, when you apply for a loan, whether at a bank or a lending institution, the lender always looks out for several things.

This is done to ensure the credibility of the borrower.

It also helps determine your capacity to repay the loan in due time.

While it is possible to get a loan with no intentions of paying it back, lenders will generally try to avoid such a situation as this.

Thus, requesting requisite information about you, not just for credibility purposes but also to better understand your financial capacity and accountability status.

Some of this information is also used to verify your identity as a customer.

Traditional Lending and Pre-Requisites

When it comes to traditional lending from banks and other credit organizations, you are better off placing your cards elsewhere to avoid touching stories.

Traditional lenders often attach strict policies and terms to their loan offers to protect themselves better from dubious customers.

Some of the many requirements for getting a traditional loan include the following:

#1: Credit Score and Rating

Your credit score and borrowing history play a crucial role in getting a traditional loan.

An individual’s credit score is a three-digit number that tells a lender whether or not that person can manage a loan properly and effectively.

A credit scoring system assesses your credit score by evaluating certain critical factors that relate to your credit and personal finances.

By determining these key metrics effectively, the system derives a score that, depending on the system, will be classified from very bad to excellent.

The system also looks at your credit history and your history of payments.

The well-broken-down score then shows your history of payment of debts, whether in your past credits or you paid money on time.

A poor credit score suggests an inability to repay loans either on time or ever!

Thus, the higher your score, the more likely your chances of getting approved for a traditional loan offer.

A good credit score more likely to qualify you for a traditional loan falls between 600 and above. This is the minimum credit requirement for a conventional loan offer.

This, in turn, improves your rating with the many lenders in the industry.

#2: Security/Collateral

Applying for a traditional loan like this often comes at a cost.

Traditional lenders will generally ask you to pledge your valuable assets as collateral for the loan offer.

For instance, let us say that you are trying to get a loan to buy a new car or home; your collateral for the corresponding loan will always reflect the underlying purpose of the offer.

It could be in the form of a cash account, investment accounts, collectibles such as coins or precious ornaments, or even real estate that ranks among the first for valuable collateral.

#3: Guarantor

Now, for those who cannot provide any form of security for their loan offer, they could also bring a family friend or work colleague of theirs to come onboard as a guarantor for the loan offer.

Usually, the guarantor is held accountable should in case you fail to make complete payment on your loan offer.

#4: Debt to Income (DTI) Ratio

This is a general requirement when it comes to short-term lending and financing.

Your debt-to-income ratio (credit utilization ratio) is expressed as a percentage and represents a part of your gross monthly income that goes toward your monthly debt service.

Debt-to-income ratio is generally used to predict your ability to make a complete settlement on your new and pending loan debt. For that reason, borrowers are advised to have at least an ideal DTI of 36% and below.

#5: Character

Some traditional lenders might require that you go through some test of character for the requested loan offer.

Here, you will be asked a series of questions where your personality will be examined according to the answers you give to the asked questions.

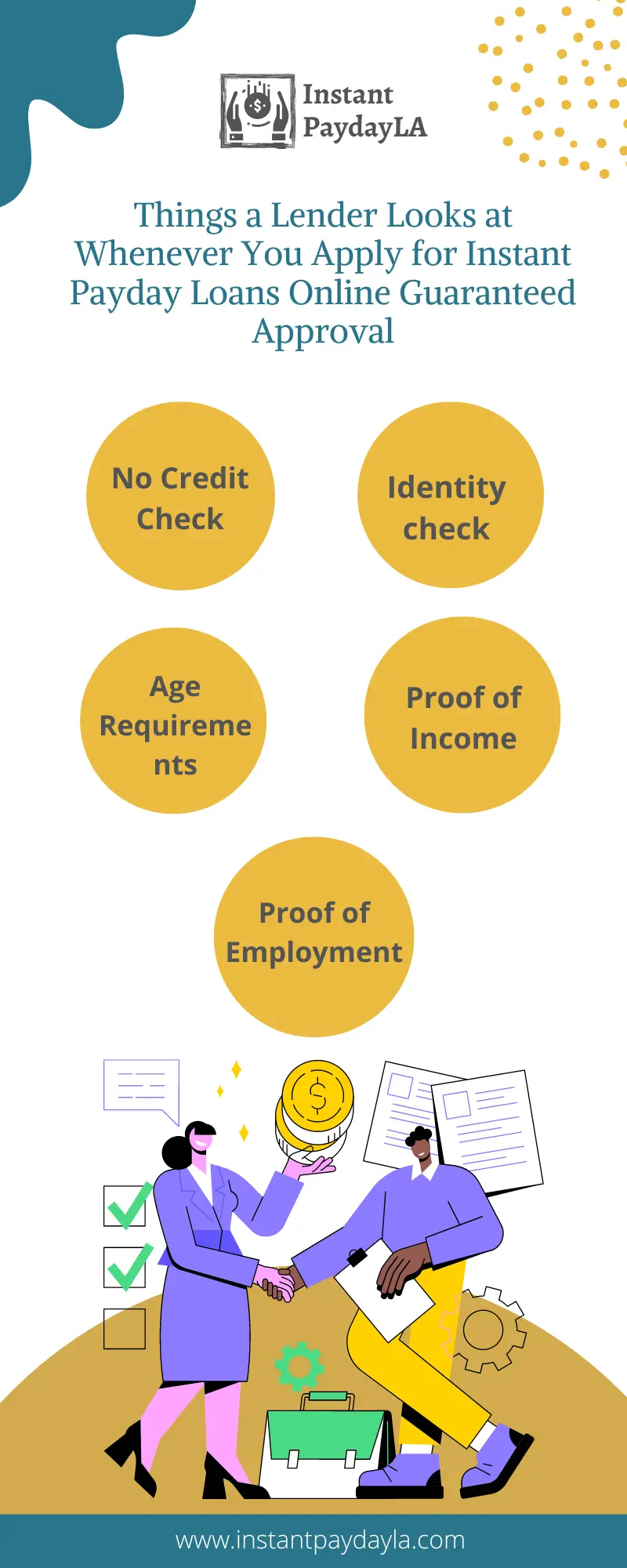

Things a Lender Looks at Whenever You Apply for Instant Payday Loans Online Guaranteed Approval

Here are some of the things lenders look out for when granting out instant payday loans online guaranteed approval to customers:

- Age requirements

- Identity check

- No credit check

- Proof of income

- Proof of employment

- Debt to income ratio

#1: Age Requirements

Age is a primary indisputable condition before obtaining a payday loan.

You must be at least 18 years old before getting a payday loan from a direct lender. Although, in some jurisdictions, the required age is 21 years; thus, it is always best to confirm and ensure that you satisfy the basic age requirements for your corresponding instant payday loans online guaranteed approval.

#2: Identity Check

When applying for instant payday loans online guaranteed approval, you must show your direct lender a verified means of identification.

This could be a national identification number, driver’s license, social security number (SSN), or any other government-approved and recognized means of identification.

Finally, only current residents of the United States are allowed access to short-term financing from direct payday lenders within the country.

#3: No Credit Check

Unlike traditional banks and credit organizations, instant payday loans online guaranteed approval come with a no-credit-check clause.

Thus, online payday direct lenders are less concerned about the current state of your finances and more about how they can lend a helping hand to you.

#4: Proof of Income

While online payday direct lenders offer short-term financing without security, you will still be required to show proof to your direct payday lender to convince them of your ability to pay back the loan debt when due.

This is one of the reasons why online payday lenders will often ask you to submit your Social Security Number (SSN) because this contains most of the necessary details about your monthly transactions and expenses.

#5: Proof of Employment

A good and steady salary shows that your income can cover your expenses and repay your debt.

Thus, to get instant payday loans online guaranteed approval from a direct payday lender, you must have a steady income coming in monthly for at least the last three (3) months.

Online payday New Orleans direct lenders often take this as a substitute for your credit score.

#6: Debt to Income Ratio

Your debt to income ratio, as discussed earlier, shows the ability of your monthly income to cover your debts.

If your monthly income cannot cover your debt, your direct payday lender may be unwilling to grant you access to your debt financing. Or still, they may also choose to offer you short-term financing, but on more rigid and strict terms of service.

This is why we always advise our customers here at InstantPaydayLA that as a way to improve your chances for instant payday loan guaranteed approval, it would help to ask for a loan amount that corresponds with your current payday.